Just because property investment is an old school investment doesn’t mean it can’t make you a lot of money. Sure, it isn’t a new age fad that people love to try and find to make money nowadays, and it might not be cool. What it is, however, is a great source of income. Plenty of investors have made millions from investing in real estate using dst 1031, and they weren’t all property moguls. In fact, some of them were average guys like you that wanted to put their money somewhere other than a bank account. If you aren’t sure whether real estate is still profitable, you can take a look at the following.

In Demand

Regardless of the current financial climate, the real estate market is back and booming. After all, people need places to live, so the demand will always be high. The good thing about high demand is that you will always have clients if you do decide to invest. Just take a look at the situation in London. Buyers are practically ripping people’s hands off just to get on the property market. The result: the demand drives the price even higher. The right house in the right area will make you a killing.

You Don’t Have To Sell

The great thing about real estate is that you don’t have to sell to make it profitable. Selling is always a good idea if a buyer comes in with a good bid but it isn’t necessary. It isn’t necessary because you can rent out the property to recoup your investment. Yes, this is a long-term strategy that might not suit your needs if you are looking for short term cash. If you have time, though, you can collect your money through rent. What’s good about this tactic is that it becomes pure profit once you pay off the loan so it also doubles as a retirement plan.

Lowers Taxes

There is a great rule called the 1031 exchange that comes into play when you buy property. It is great because it helps you defer taxes if you buy a property and sell it for a like-for-like replacement. So, in real estate what is a 1031 exchange? To give you more perspective, it is also known as a wealth-building tool. In layman’s terms, you can defer taxes on the investment for the rest of your life in reality. In the meantime, you can collect your monthly rent without worrying about paying the taxman. This rule alone should be enough to make you invest in real estate.

Add-On Value

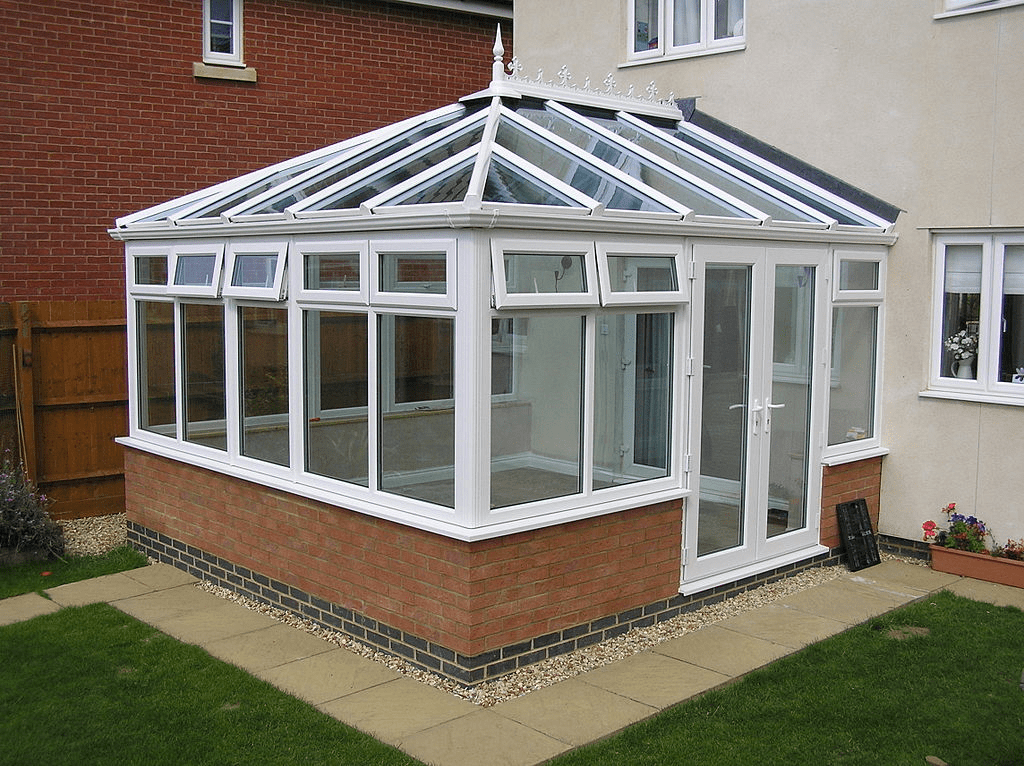

A property’s value doesn’t have to stay the same if you are proactive. There is plenty of ways to increase the sell-on value of a property if you take the right action. A conservatory, for example, is a relatively cheap addition, is highly valued by buyers, and adds a lot onto the value of the house. A pool on the other hand often doesn’t recoup what it costs to install. As long as you pick the right extras you can increase the value of the property by a huge margin.

The next time someone says ‘is property still profitable?’ you will know the truth – of course it is.