How Much Can I qualify for on a Home Loan when I make $50,000 Salary?

If you’re looking for a home loan, the biggest question is how much loan you are eligible for and how much you should borrow. A loan for purchasing a home for salaried professionals depends on various factors such as income, credit history, etc. Its best to research a Home Loan Calculator before looking at home to purchase.

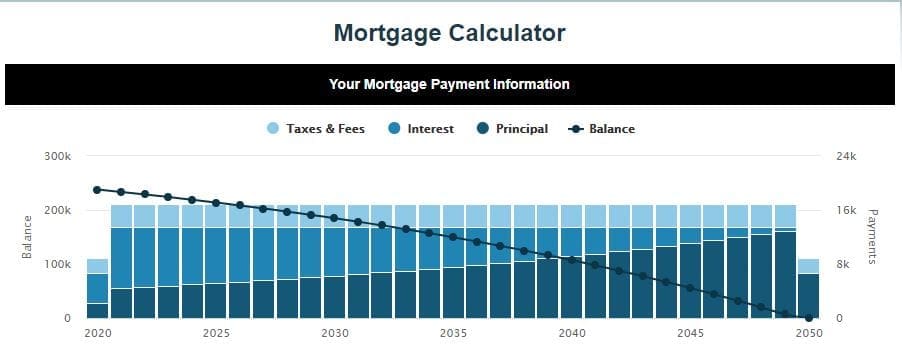

It is also essential to remember that a home loan EMI can be an enormous financial burden on your monthly expenditure, causing your cash-flow to go haywire. Therefore, EMIs should ideally not be more than 45-50% of your monthly take-home salary. EMI stands for “Equated Monthly Installment.” It includes repayment of the principal amount and payment of the interest on the outstanding balance. Don’t forget to consider taxes and insurance on top of the payment.

Consider the Following Example:

- If you earn a $50,000 yearly salary, then you shouldn’t be paying more than $700 towards your home loan EMI.

- A home loan for a $50,000 salary can get a maximum loan amount of $120,000 at a 3.8% interest rate for a 30-year term. The home loan EMI that you would be paying in this situation would be around $700 per month.

The maximum term that most financial lenders offer for a housing loan is 30 years. Therefore based on your income and expense you can play with the number between 10 year terms and 30 to see what works best for you.

* These calculations are done using a home loan EMI calculator and are based on a fixed ROI of 3.8%. Individual interest rates and terms will vary depending on the lending institution and borrower’s credit history.

Short vs. Long Term: Which to Choose?

Before choosing your home loan term, be aware that longer terms increase the cost of borrowing. Simply put, you will be paying more interest for a 30-year-long home loan compared to a 20-year one. Taking a longer-term might seem like a tempting option as you will be paying lower home loan EMIs, but it also means that higher will be the compound interest that the lender earns from you, hence a shorter tenure is a better choice.

However, while taking a housing loan to purchase a home for salaried professionals, it becomes crucial to go for a longer-term. Why? If you have a low income, you will be unable to borrow enough money if it is 10 or 15 years.

This is why it is ideal to use a home loan EMI calculator before applying for a loan as it helps you know the maximum amount that you are eligible for.

Importance of a Home Loan EMI Calculator

A home loan EMI calculator helps measure potential monthly installments accurately. The calculator considers factors like income, terms, and other financial obligations to calculate the available home loan amount.

Additionally, remember that financial lenders assess home loan eligibility based on your debt-to-income ratio. If you are already burdened with EMIs, the lender might feel that an additional home loan can result in delayed or non-payment of EMIs. This might reduce your chances to avail of a home loan at low-interest rates.

Therefore, foreclosing pre-existing loans and paying off credit card debts is a great way to increase your home loan eligibility. Lenders also look at your CIBIL score to determine your home loan eligibility. Your credit or CIBIL score should be a minimum of 750. Therefore, always keep a check on your credit score and easily avail of a home loan with a salary of $50,000.