One of the most influential figures in your life is your credit score. It can affect whether you are approved for a loan, the interest rate you will pay on the loan, and even your ability to rent an apartment. A poor score can negatively impact all aspects of your life. So you must understand what it is and how to improve it. This blog post will explore a lousy credit score, how to improve your finances, and how to enhance your score.

What Is a Bad Credit Score?

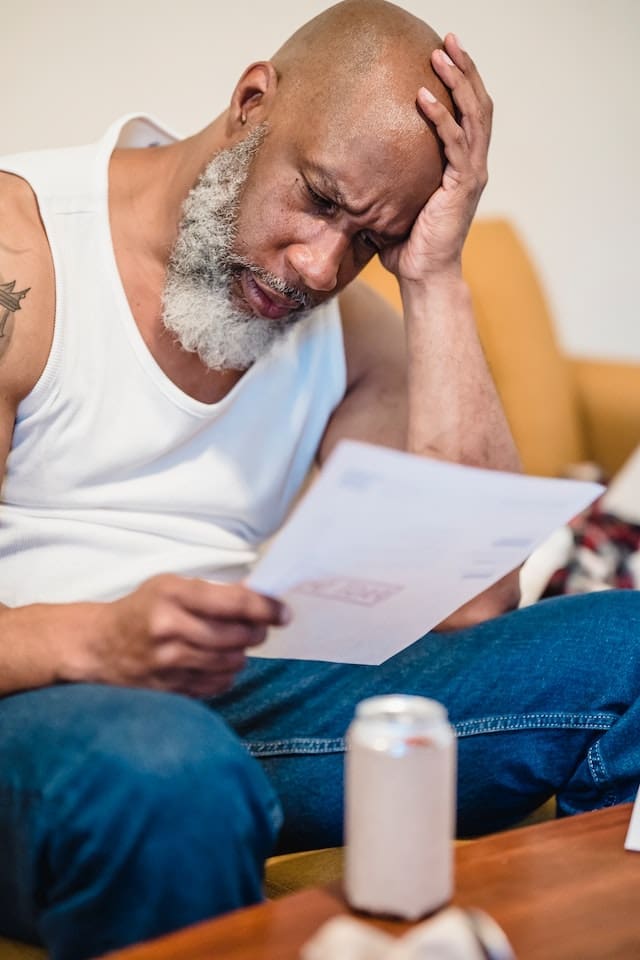

Champion talks about why credit scores are bad. Your credit score is a three-digit number that ranges from 300 to 850 and is determined by various criteria, including the duration of your credit history, the percentage of your available credit being utilized, and your payment history. It is considered good when the score is at or above 700 and significant at or above 800. Anything with a value lower than 600 is thought to be hazardous. There are ways that you can enhance your score if it falls within the range that is considered to be poor.

Why Does an Employer Care About My Credit Score?

A credit check may be required for financial or fiduciary responsibility positions. Other types of employers may wish to check a candidate’s credit history. For example, if you’re seeking a job at a company selling high-end things such as jewelry, a clean credit report can demonstrate that you’re financially stable and less inclined to steal merchandise.

Along those lines, you should expect a credit check if you’re applying for law enforcement positions, government agency positions, or any other positions that give you access to other people’s personal confidential information.

In some circumstances, the employer is more concerned with detecting application fraud than your financial situation. “They’ll examine the credit report to confirm that you are who you claim you are,” Griffin explains. This might be used more for jobs that need high-risk operations, such as government jobs or labor that requires a security clearance.

If you’re worried about a background check, a less-than-perfect credit report may not exclude you from the job, but it may be a decisive factor. Consider this: Who do you think the company will choose if you have a choice between two equally qualified candidates, one with perfect credit and one who is overextended and in serious debt? PaydayChampion explains everything.

How to Improve Your Finances

If your credit score is low, one of the best things you can do to improve it is to work on strengthening your financial situation. This entails formulating and adhering to a budget, making timely payments of obligations, and maintaining a manageable level of outstanding debt. Increasing your salary is another way to help better your financial situation. One way to accomplish this is to acquire additional income sources or find a job that pays significantly more.

How to Raise Your Credit Score

There are some different actions you may take to improve your credit score. One is to ensure you are prompt in paying all of your payments. Another is to maintain a low balance on each credit card. You can also raise your score by establishing additional lines of credit and making responsible use of the ones you already have. Finally, settling any outstanding financial commitments you may have can enhance your score. Debt relief agencies offer valuable advice and guidance to help you along this path. Options like credit card debt forgiveness programs or debt relief plans are offered worldwide. Clearing your credit card debt can be a game-changer for your financial status, giving you a fresh start to improving your credit score.

How to Improve a Bad Credit Score?

If you have a bad credit score, there are things you can do to improve it. You can make sure you pay all of your bills on time, keep your credit card balances low, and use new lines of credit responsibly. You can also raise your score by paying off any outstanding debts you may have. By taking these steps, you can improve your score and finances.

How a Bad Credit Score Can Impact You

A bad credit score can harm all areas of your life. It can make it challenging to get approved for loans, raise interest rates, and even affect your ability to rent an apartment. If you have a bad credit score, it is essential to improve it.

What factors influence your credit score?

Several factors influence your credit score. These include your payment history, credit utilization, length of credit history, and other factors. You can improve your score by making on-time payments, keeping your debt levels low, and using new lines of credit responsibly. By taking these steps, you can improve your score and finances.

How can you get a free credit score?

There are several ways to get a free credit score. You can sign up for a free trial with a credit monitoring service, use a credit card that offers a free credit score, or check your score on websites like Credit Karma or Credit Sesame. By taking advantage of these free resources, you can stay on top of your score and make sure it stays in good shape.

Why is having good credit important?

Good credit is essential because it can impact all areas of your life. A good credit score can help you get approved for loans, get a lower interest rate, and even rent an apartment. By taking steps to improve your score, you can improve your finances and ensure you can take advantage of all the benefits of having good credit.

How to Make sure your credit history is accurate?

One of the best ways to ensure your credit history is accurate is to check your credit report regularly. You can get a free copy of your credit report from each of the three major credit bureaus every year. Reviewing your account can catch errors and ensure all the information is accurate. You can also dispute any inaccuracies that you find.

What to do if you have a low credit score?

If you have a low credit score, you can take steps to improve it. You can make sure you pay all your bills on time, keep your debt levels down, and use new lines of credit responsibly. You can also raise your score by paying off any outstanding debts you may have. By taking these steps, you can improve your score and finances.

A bad credit score can significantly impact your life, but there are things you can do to improve it. By making on-time payments, keeping your debt levels low, and using new lines of credit responsibly, you can raise your score and improve your finances. By taking these steps, you can improve your credit score and life.

Author: Jay Batson

Aubrey Saffa Bender has been a freelance journalist and journalist since 2013. She writes about topics that range from personal finances and education to technology and business. In her work for PaydayChampion, Aubrey primarily draws from her writing experiences regarding mortgages, home purchases, and real estate. She graduated with a B.A. with a major in English at The University of Colorado Boulder.

Featured Photo by Nicola Barts : https://www.pexels.com