Do you live in California and require a short-term loan to help you until your next payday? If this is the case, we have the ideal answer for you! You can apply for Up To $255 Payday Loans in California on our website without needing a credit check. This implies that you can obtain the funds you require even if you have low credit or no credit. So don’t put it off any longer; apply online now!

What Is A Payday Loan?

Payday loans are short-term loans often taken out to cover costs arising between one paycheck and the next. The amount of money you can borrow will depend on your income and the state you live in, but it can be anywhere from $100 to $255. Even if you have a poor credit history or none, applying for a payday loan is not difficult. This is one of the many advantages of these types of loans.

What Do I Need To Get a Payday Loan in California?

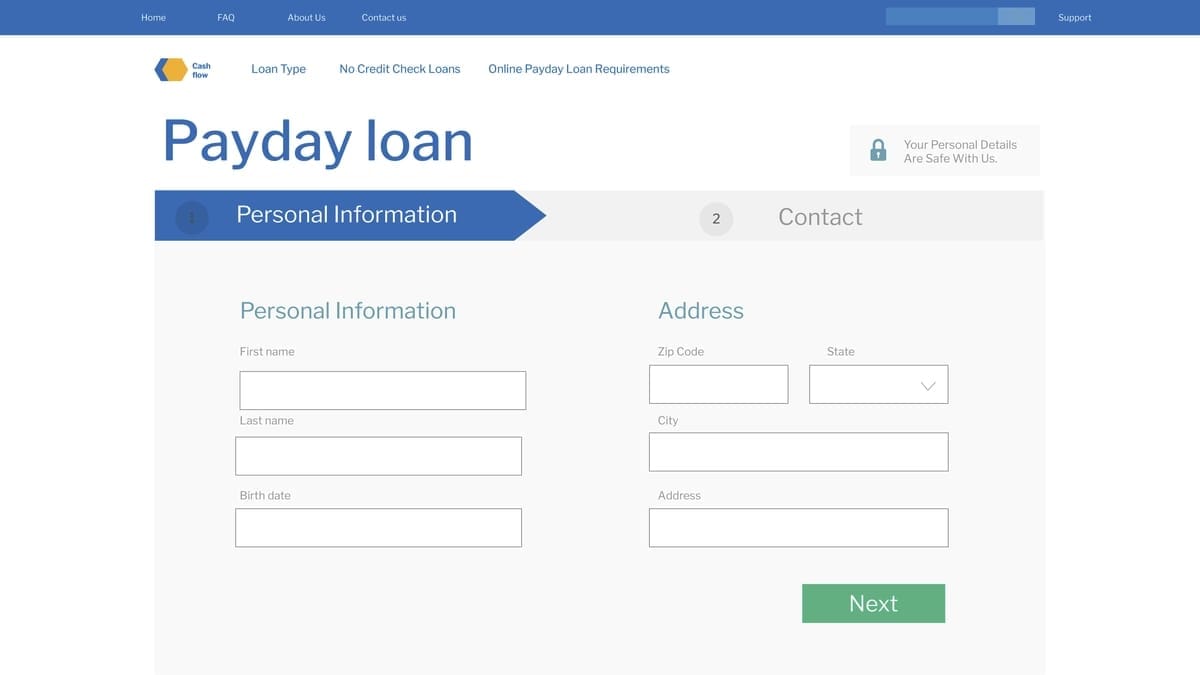

You need to give us some basic information about yourself to apply for a payday loan in the state of California. This information includes your name, address, phone number, and email address. In addition, you will need a reliable source of income and an active bank account. That wraps it up! As soon as we have received from you all of the information that is required, we will be in a position to lend you the money that you need within the next twenty-four hours.

Provided you live in California and need a short-term loan to get you through until your next paycheck, you may apply for a payday loan in California of up to $255 on our website right now if you meet the requirements. Because we offer loan applications in California in a quick and easy format online, and because there is no requirement for a credit check, even if you have poor credit or no credit, you will still be able to acquire the money you require.

What are California Loan Amount & Terms?

In California, the smallest amount that can be borrowed is $100. The maximum amount that can be borrowed is $255. The loan terms might range anywhere from one week to 31 days. A financing charge of $17.65 is applied to a $100 loan for 14 days. This results in an annual percentage rate (APR) of 460 percent. * * The Annual Percentage Rate, also known as the “APR,” is the cost of credit expressed as an annual rate and can range anywhere from 300% to 780%. The annual percentage rate for loans greater than $500 is 400%.

The date you begin repaying your loan is used in calculating all APRs, not the date that the loan was initially taken out, as is the practice of many other lenders. Because of this, the day your first payment is due might not be the same day your subsequent payments are due. Before concluding your loan agreement, the law requires lenders to provide you with the APR. The annual percentage rates (APR) are subject to change.

How to Get California Online Payday Loans?

Obtaining California online payday loans is simple! Simply fill out our online application form, and one of our representatives will contact you to discuss the terms of your loan. After everything is in order, the funds will be put into your bank account within 24 hours. It’s that easy! So don’t put off applying for Up To $255 Payday Loans in California at our website! We provide quick and easy online applications with no credit checks necessary, so you can acquire the money you need, even if you have bad or no credit.

What Happens If I Can’t Repay My Loan?

If you find that you are unable to repay your loan, you might be able to get it extended or set up a payment plan instead. However, additional costs will be incurred with the selection of these choices. After exhausting all these options, the lender may decide to pursue legal action against you if you can still not repay the loan.

When Should I Use a Payday Loan?

Payday loans are often reserved for usage in the event of unforeseen financial emergencies or obligations, such as the payment of medical bills, car repairs, or other unexpected costs. They are not to be utilized for day-to-day living expenditures or spending money on whims and fancies. If you frequently need cash advance loans, it is necessary to seek the assistance of a qualified financial specialist to get your finances back on track.

A Payday Loan of Up to $255 is a Quick and Easy Method to Get the Money Needed Need to Cover Unexpected Expenses or Emergencies in California Taking out a Payday Loan of Up to $255 in California is a quick and easy way to get the money to you. Because we offer applications in a quick and easy format online, because there is no requirement for a credit check, even if you have poor credit or no credit, you will still be able to acquire the money you require.

What are the Terms for California Residents in terms of payday loans?

The times for California residents in terms of payday loans are as follows:

- The minimum loan amount is $100.

- The maximum loan amount is $255.

- Loan terms vary from one week to 31 days.

- The finance charge for a 14-day $100 loan is $17.65.

This loan type’s Annual Percentage Rate (APR) is 460 percent. These rates are subject to change at any time.

Residents of California can apply for these loans online with no credit check required. Once approved, the money will be deposited into your bank account within 24 hours. If you cannot repay your loan, you may be able to extend your loan or enter into a payment plan; however, additional fees will be associated with these options. If you can still not repay your loan after taking advantage of these options, the lender may choose to take legal action against you.

Payday loans should only be used for unexpected expenses or emergencies and not for regular living expenses or discretionary spending. If you need to use a payday loan regularly, it is vital to seek professional financial help to get back on track financially.

What else does Ipass offer different ways to receive online loan funds?

Ipass provides several different ways to receive online loan funds. In addition to our quick and easy online application, we offer the option to apply by phone or in person at one of our many convenient locations. Whichever way you apply, we will work with you to get you the money you need as quickly and efficiently as possible.

How do we pick alternatives to California payday loans?

When we pick alternatives to California payday loans, we look for lenders that offer competitive rates and terms. We also consider the lender’s reputation and ensure they are licensed to lend in California. We only work with reputable lenders with a proven track record of providing excellent customer service. So when you are looking for alternatives to payday loans, be sure to check out our website. We can help you find the best lender for your needs and get you the money you need quickly and easily.

Why choose a California-licensed direct lender for your online payday loans?

When you select a California-licensed direct lender for your online payday loans, you can be confident that you are working with a reputable and trustworthy company. Direct lenders must follow all state and federal laws, which means they are subject to strict regulation. This ensures that they offer fair and competitive rates and terms. It also means that they must provide excellent customer service. So when looking for online payday loans, be sure to choose a California-licensed direct lender. You can be confident that you are getting the best possible deal on your loan.

Celine Jesza Afana

Personal Finance Writer at Ipass

Celine Jesza Afana is a Finance writer at Ipass, an online leader in a payday loan company, providing fast, easy, and safe payday loans online to its customers. Celine has extensive experience working in the financial industry, with a specialization in lending and administration management. She is also proficient in customer service, customer services, and various payday lending industry functions. She has been working hard in the company’s efforts to help those with jobs that aren’t so easy and financial issues get money when they require it the most.

Featured Image by rawpixel.com