Keeping our finances in check, saving some money, getting our budgets on the right path – we all want to achieve such goals and we all feel frustrated and even depressed when our savings seem to be getting smaller, not bigger.

Keeping detailed lists of the things that consume your budget and shopping for the smallest price when doing groceries are easy things to implement. Everybody does them these days, but they do not seem enough for you to feel relaxed from a financial point of view.

What other means are there to keep your money in check and even save some to enjoy life? Here we propose ten such ways. Some may seem to require effort and time on your part, but you have to remember that you are in for the long haul and they will show their advantages in due time.

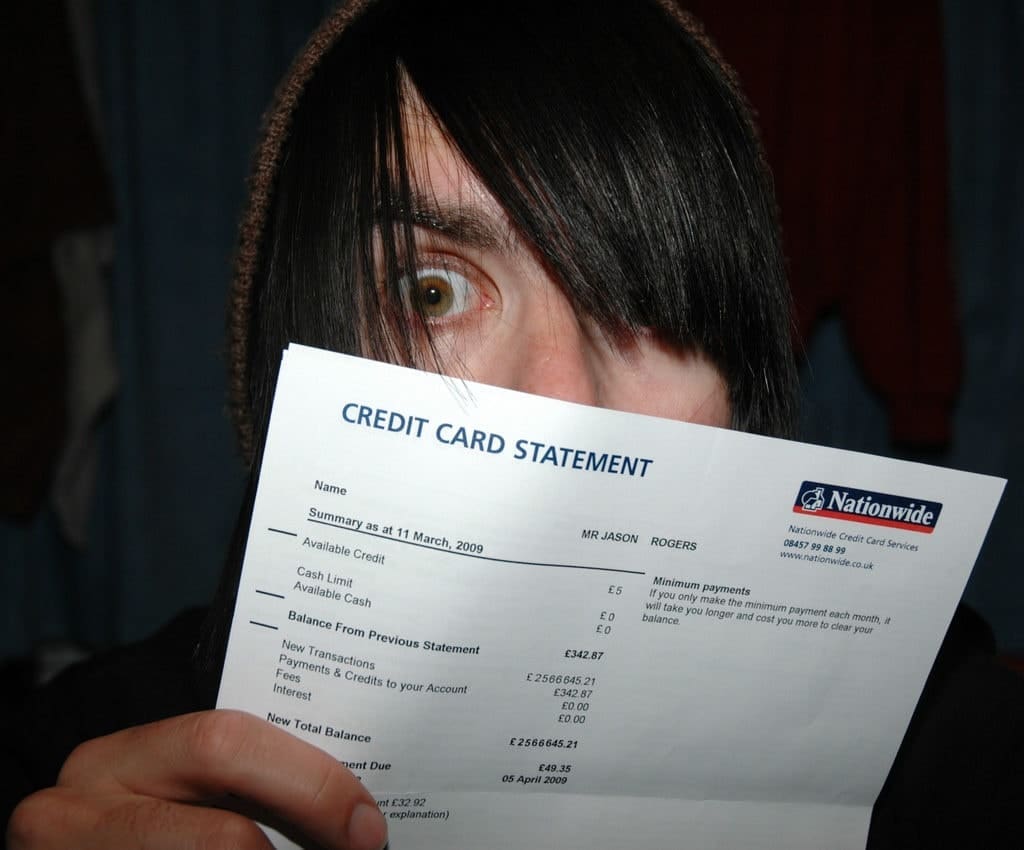

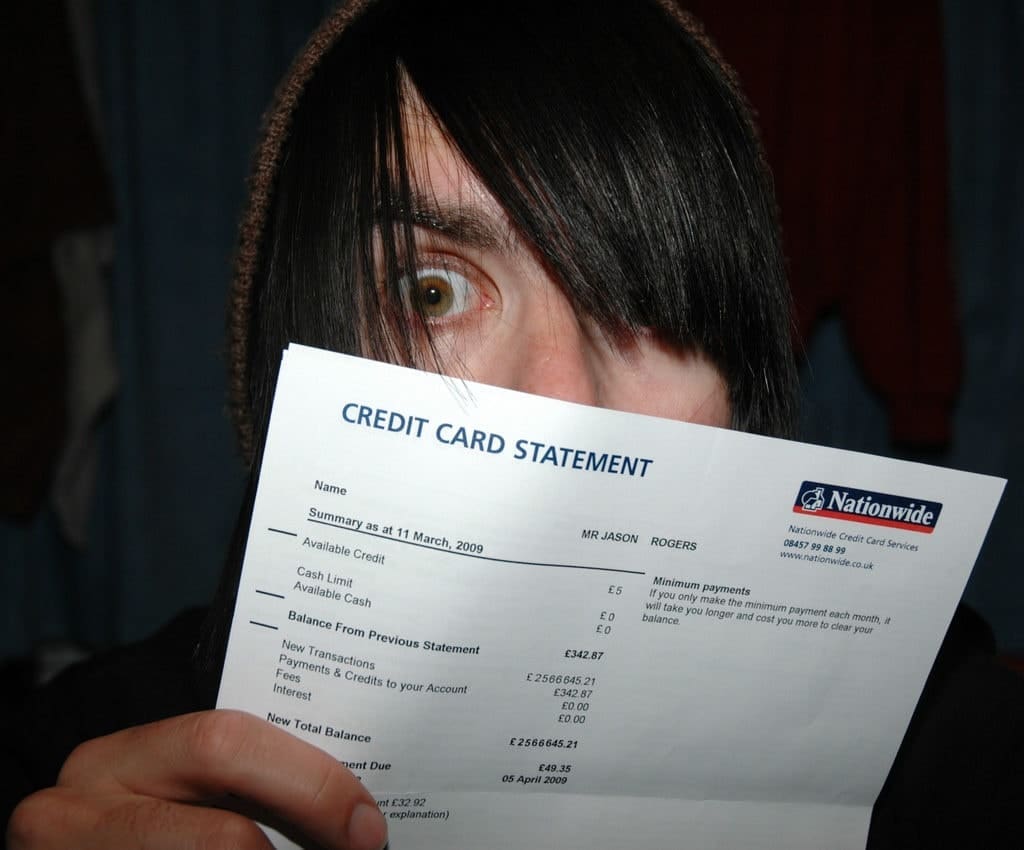

1. Review Your Last Six Months of Expenses

It is easy to tell people to save money starting today but difficult to advise them how to begin. What should you give up? Food, bills, household items, hygiene items, medicine? In order to understand what your costs are and how you can reduce them in the future, you need to review your last six months of expenses.

- Analyze your bank and credit card statements and look for recurring expenses you do not need or use in reality and cancel them. Overlooking small charges is easy, but not beneficial, as such expenses amount to significant sums over time. Accordingly, with this in mind, you might also want to consider reaching out to a credit scoring and reporting company such as credit sesame for some additional financial support.

- Analyze your grocery bills and look for items you purchased on impulse rather than on need. You may want to pay attention to them and avoid them in the future.

- Analyze your other bills and look for goods and services you can give up or replace, at least for a while, until your budget comes back on track. If you are dedicated to exercises, you can replace your gym subscription with home yoga or outdoor jogging. If you can wash your car free at the gas station, do it. If you can cook, make a meal plan (which is actually healthier) to replace restaurants and fast food as many days a week you can.

- Analyze your splurges and vices. Nobody wants to hear this, but your smoking costs you plenty in terms of money and health. Cut it back if you cannot quit it cold turkey. It goes the same for alcohol and other things that are bad for you and your budget. While nobody says you should start living pauper style, cutting back some splurges or some vices will do you and your budget a world of good.

2. Find Discounts to Medicine and Health Items

We are sure you are already looking for discounts when it comes to groceries and household items, without turning your life into a coupon frenzy. However, while we tend to look for cheaper produce, for instance, we tend to pay the full sum when it comes to medicine and health items.

Medicine and health are extremely expensive and they do not seem to stop becoming even more expensive. The basic medical care we need, the basic over-the-counter drugs, and medical accessories can dry our pockets instantly if we do not pay attention.

This is where apps come in. Use apps that offer instant deals and coupons or promotion codes for a wide variety of stores, including drugstores. Through these apps, you could even get some cash back for shopping to help you save some money. Search the internet for pharmacies offering discounts, especially if you or your family have to follow recurrent treatments.

3. Search for Cheaper Insurance Policies

We spend a lot of money on health insurance, but we cannot go without it. If we care about our lives and the well-being of our families, going without health insurance is worse than paying high premiums, because health bills can push a family to bankruptcy. While we all fear medical debt and we are all trying to find the best solutions to cutting down our premiums, we have to understand a few things.

First, when you go shopping for cheaper or different health insurance, factor in all these aspects:

- Subsidies or tax credits you can get

- The real health needs of your family

- The money you really afford to pay out of pocket

Many think that getting health insurance with the lowest premium will solve their financial problems in the long term. However, first, consider how much you are really going to get out of your plan and then factor in the premium and the deductibles.

A similar strategy works for car insurance, life insurance, home insurance, and more. We cannot completely avoid such expenses, but we can cut them down if we spend some time analyzing our needs. Shopping for cheaper insurance is just the first step to make. You can continue by keeping your credit clean, as car insurers usually check it out. You can also shop for discounts on combined policies, and so on.

Understanding insurance – its benefits and its drawbacks – takes some time and some calculations, but you can stir your budget on the right path without endangering you or your loved ones.

4. Maximize your 401(K) investments

If you contribute to the regular 401(K) plan or other retirement plans, increase the amount of your annual investment. This may seem counterproductive, but the logic is this: if you increase the amount by only 1%, you will probably not even feel the difference in your budget. However, for your 401(K) plan, that 1% may translate into serious savings over time.

As we said, some of these financial tips do not come with instant gratification. You should think about the future because if you only want to make ends meet this month alone, using coupons for groceries is always a good and fast method to save some cash.

5. Keep Your Debts in Check

A report in 2017 showed that the average American household has to deal with around $15,000 in credit card debt. If your credit card debt is giving you nightmares and financial problems one month after the next, you should start thinking about lowering such expenses. You have two ways of making things easier for you:

- Start making an extra payment. Again, it sounds counterproductive, as you want to save money and not spend more money, but reaching financial balance means strategizing. Skip some splurges this month and pay a little of your credit card debt. It will help in the long run, because high debt means high interests. If you have to deal with different types of debts, but the extra money in the one that comes with the highest interest.

- Find a way to transfer your credit card debt to a credit card with 0% APR (annual percentage rate) for a few months. Such offers help you pay off your debt in a comfortable amount of time without paying interest. You can find few good transfer options for the ones who keep credit cards with high interest.

If your major problem is your student loan, you should apply the same logic: the interests on your loans and credits dry your budget on a monthly basis. Comparing student loan refinance rates is a great way to start dealing with your debt in the long run.

6. Check out Your Phone Plan and adjust it accordingly

It is not news that Americans pay much more for their phone plans than Europeans, for instance, getting less for their money, in fact. We are used to paying our phone bills monthly, without giving them a second thought. However, if you want to cut down expenses on a monthly basis, it is time for you to try to detangle the phone plans available on the market today.

It is a very hard job, as they are intentionally vague and hard to follow, but you need to have patience and compare prices until you get a plan that both suits your budget and needs. If you search thoroughly, chances are you will find a good offer for less money but with the same benefits.

7. Eliminate some unnecessary fees

You may not know this, but a large amount of your monthly budget goes to fees – many of them unnecessary. In order to keep your finances in check, you need to go to the drawing board and start tracking your expenses dime by dime. Besides the obvious expenses, a rigorous search will lead you to find plenty of fees you could avoid:

- ATM Fees – probably the most common fees you pay and you could avoid using only your bank’s ATM. If not possible, at least try getting your cash from free ATMs run by credit unions that have large co-op networks.

- Late payment fees – you should really try making your payments on time to avoid such fees.

- Money transfer fees – try to find alternative solutions involving free money transfers.

- Shipping fees – you can count on your Amazon Prime account to pay for itself in shipping costs of the course of a year, or you can try finding offers, coupons, promotions, and discount codes allowing you to opt for free shipping or at least discounted prices on items delivered with transportation fees.

- Unused subscriptions – make a list of all your subscriptions and try eliminating those you don’t use. A few bucks for a subscription may not seem much, but the total sum can add to a significant amount you can save or use to pay debts.

8. Get some things free or very cheap

We live in a highly developed world where we can find alternatives for almost anything. Cutting down some expenses for saving money or dealing with debt means getting a bit creative with the opportunities you already have.

- Use online services – which are free – instead of making phone calls or sending SMSs (Skype comes to mind).

- Use forums and online marketplaces to swap items or to get items people donate – it is not healthy to get a mattress somebody else threw away, but you can find small treasures to use without spending your own money on them (garden, household items).

- Use the Internet for DIY projects. If you need to revamp your home but the budget is already an issue, learn how to repurpose items you already have around the house and turn them into new things you can use. If one can make a bed out of wood pallets in half a day, there is no stopping you. You will find a gazillion YouTube tutorials and written guidelines on how to make new things out of old things, so just go with the flow if money is a problem.

- If you get into DIY projects, take the opportunity to learn how to do some work around the house safely and efficiently without paying some specialists to change a pipe or to paint a wall.

- Save on gas and car wear/tear by sharing rides with friends and neighbors or using a legit carpooling system. It will save the environment and help you save your money.

- Repurpose your food leftovers into gourmet works of art. We now have an app for anything, so you can use one that offers creative ideas on how to turn your leftovers into deliciously fresh dishes. We throw away so much food and we waste so many resources we should all use such food-saving apps whether we worry about our budgets or not.

9. Free or cheap entertainment

Saving money and keeping your budget in check does not mean you should start living frugally, giving up your life, and shake with fear of debt. If you still want to have fun on a budget until your finances recover, you can also start trying free forms of entertainment:

- Look for museums offering free admission on certain days or periods – you can expand your culture and education this way as well.

- Borrow books from the library – a library card does not equal the money you spend on books and libraries have a charm you will love.

- Attend events and concerts with free admission – many new artists trying to make a name for themselves organize art exhibits, music concerts, and so on free of taxes so the public gets to know them better.

Search the Internet for such free opportunities or share a ticket with a friend or family and have some fun. Saving money should not become a dreadful, joyless experience.

10. Free samples and free services may help you put some money on the side

Again, you should not enter a paranoid state and dedicate your future to coupon shopping or hoarding free samples for everything. However, you can take advantage of free samples or services on many things without feeling like a beggar. Here are a few examples:

- Get a free medical checkup – many medical associations and medical NGOs offer free consultations and tests to promote prevention medicine. You can save some doctor money getting a blood pressure test, a glycemic test or an eye test for free.

- Many pharmacies and doctors’ offices keep medication samples you can ask for if they can help you with your medical needs.

- Many specialty shops and brands offer cosmetic, self-care, hygiene, or perfume samples. Use them without guilt. When your budget is back on its feet you know what products to buy in the future.

Saving money and balancing debts may be hard, as we said, but it is not impossible if you are honest with yourself and thorough in your research of expenses you do not really need or can cut back.

Authors Bio:

Jennifer Clarke is a financial advisor who has been in the healthcare industry for nearly 4 years. When she’s not working with numbers, she’s writing on her personal project, HealthCareSalariesGuide, a blog-type website that aims to give accurate depictions of healthcare salaries.