If you are averse to the idea of taking risks but still keen to invest, you may need to know that risk-free investments are as non-existent as safe high-risk investments. Every investment comes with risk, only the size of the risk varies. Hence, the simple rule to optimize your investment is to look for low-risk investments.

Are Low-Risk Investments Worthy?

One of the important benefits of low-risk investments is that even in case of a loss you will not feel the pinch. Money saved is money earned, right? And that is not all; keeping your money locked up in the bank is not going to be rewarding whereas low-risk investments offer a better deal. While low-risk investment is not going to fetch you a fortune, you are not going to lose yours either.

Low-Risk Investments

Here are some of the best low-risk investment options:

- Bonds

- Certificates of deposits

- Money market funds

- Treasuries

- Government funds

How To Maximize Your Benefits

Not only a beginner but also those who have been investing for quite some time do get carried away at times making wrong investment and losing hard-earned money. It is always best to err on the side of caution but in the investment scenario some lessons are learnt the hard way. Here is what you look to earn more from low risk investments that are safe and trustworthy.

1) Know Your Risk Tolerance Level

The integral part of wise investment is knowing your risk tolerance level. Risk tolerance level refers to your ability to withstand a particular level of loss in investment. In short, it refers to the amount of money you can afford to lose without such loss affecting your living standards in anyway.

Risk tolerance level depends on the following:

- Age

- Level of income or financial stability

- Prospects of growth in monthly income

- Financial demands, if any, in near future

- Financial goals completed with nation 21 quick cash lenders

Above all, your mental makeup should also be taken into account while assessing your risk tolerance level.

2) Importance of Long Term

One of the traits that a good investor possesses is patience. The market scenario influences your investment either positively or negatively. Whichever way it impacts, it is best to hold on to the investment for long term as there is almost a definite possibility of the loss, if any, being absorbed and whatever earnings your investment produces gets multiplied thereby letting you enjoy better returns.

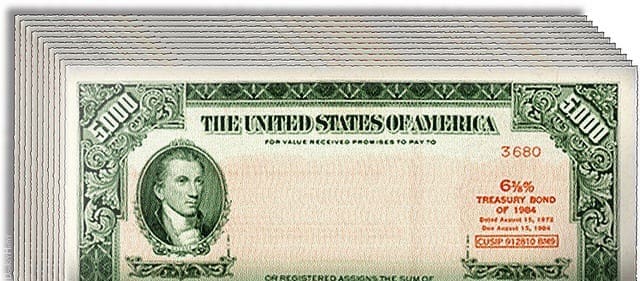

3) Bond With The Best Bonds

Bonds are always a recommended part of one’s investment portfolio. Your choice of bond depends on your needs. Out of the different types of bonds these bonds can hardly be a cause to lose your sleep over your investment.

- Treasury Bonds: If security of investment is your top concern though with very minimal returns, treasury bonds are right for you. The added advantage is that the interest you receive from treasury bonds are exempt from income tax.

- Savings Bonds: If you would not lay your hands on the money invested at least for a period of one year. The advantage of savings bond is that the interest rate is fixed and so you have a clear picture of funds that will be available to you on completion of the term which helps with the planning. However, the other side to fixed rate and to your disadvantage is that even if there is an increase in interest rates, you will still only be paid what was originally on paper.

4) Diversification

As the famous saying goes “Don’t put all your eggs in one basket”, a wise investment idea would be to diversify. Considered one of the best ways to minimize risk, diversification is one of the must-learn and must-follow rules of investment. Here is how you diversify your investment.

- Invest not in one company, but in quite a few to ensure that the setback you experience owing to bad times of a company is balanced by the growth of the other.

- Investing in various sectors help minimize risk of loss. If you invest only in one sector and it suffers a crisis, your financial status is in for trouble. Hence, it is best to have your investments made in different sectors.

- One of the best ways to diversify is to have bonds, stocks, fixed assets and cash in your investment portfolio. While bonds provide regular income, a rise in the stock market increases the value of your stocks. Fixed assets are always a great addition as appreciation of property helps you earn returns multifold.

While diversifying brings in benefits, if you plan on a low investment, you need to take into account the trading charges you pay while buying different stocks.

5) Learn To Say When

Just as you should know how to invest equally important is to know when to sell your stock. If the price gives you a comfortable gain you may want to sell it. While holding the stock for some more time may give you better returns the possibility can also be otherwise. Hence it is best for low risk investors to sell when the price is still going higher. It is also recommended to sell a stock if there has been no progress for a considerable period of time so that you can minimize risk of loss or minimize your loss.

The market has its ups and downs. There may come times when you are happy you sold a stock for a profit before its prices slumped. There may also come times when you sold a stock for a profit but see its prices go much more higher. However, it is best not to regret as it would only negatively influence your future investment decisions.