What Defines a Venture Capitalist?

The success of many transformative startups is often fueled by visionary venture capitalists who contribute far more than just funding—they provide mentorship, expertise, and strategic direction. By backing early-stage companies, they empower entrepreneurs with the tools to navigate complex markets. Their influence reaches beyond financial support, as their networks, foresight, and business acumen help shape the path of innovation. Figures like Bill Malloy, whose accomplishments and Bill Malloy Net Worth reflect impact and experience, exemplify how a VC’s role can define the trajectory of groundbreaking ventures.

Venture capitalists operate at the intersection of opportunity and risk. Their decision-making process involves identifying high-potential companies and supporting them in scaling operations, developing products, and expanding into new markets. This symbiotic relationship enables startups to access global markets faster, contributing to economic dynamism and job creation. The modern VC is a catalyst for both entrepreneurial success and macroeconomic growth.

The Role of Investors in Today’s Economy

Investors play a pivotal role in directing the flow of capital and shaping entire industries. By prioritizing sectors such as renewable energy, healthcare innovation, or artificial intelligence, they influence technological progress. According to The Wall Street Journal’s finance section, investor sentiment is a major driver behind tech booms and busts, impacting public and private markets.

Beyond simply providing funding, investors often act as silent partners, offering guidance and oversight as companies pursue profitability. In today’s digital-first world, investors are fundamental to supporting startups tackling significant challenges, from global health crises to climate change. Their risk tolerance and vision help translate inventive ideas into market-ready solutions that push society forward.

The Technologist Mindset Driving Advances

At the heart of innovation beats the technologist’s mindset—one defined by curiosity, experimentation, and relentless pursuit of efficiency. Technologists are the architects of change, applying tools like cloud computing, machine learning, and blockchain to build disruptive products and services. Their willingness to iterate quickly and learn from failure underpins startup culture and helps organizations respond swiftly to shifting market dynamics. As reported by Forbes Innovation, technologists’ adaptability is essential in ensuring companies remain competitive and future-ready.

This mindset also involves a commitment to lifelong learning. New programming languages, platforms, and frameworks constantly emerge, requiring technologists to evolve continually. By doing so, they unlock new possibilities for business growth and societal advancement, bridging the gap between visionary concepts and practical implementation.

Giving Back: The Philanthropist Approach

Philanthropy has become a defining trait of today’s most influential investors and technologists. These leaders use their wealth, time, and expertise to address systemic issues and empower underserved communities. By supporting initiatives in education, global health, and environmental sustainability, they create ripple effects that far exceed the reach of individual companies. Philanthropy is increasingly seen as a means to give back and a strategic lever to create more equitable, resilient societies. For further reading, visit The New York Times Giving section.

Notable philanthropists often leverage their entrepreneurial experience to improve the effectiveness of charitable initiatives, applying outcome-driven methodologies and forming partnerships with nonprofits and governments. This intentional approach ensures that social investments are impactful, measurable, and sustainable over the long term.

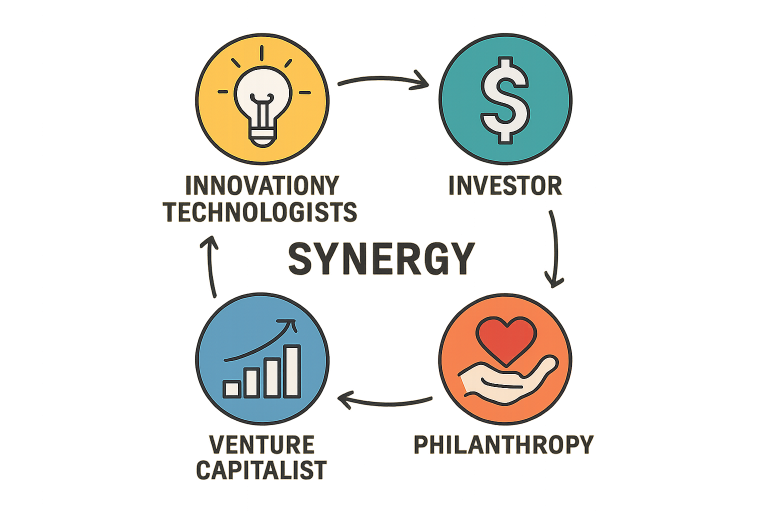

Synergy Between VC, Investor, Technologist, and Philanthropist

There is tremendous value when an individual combines the roles of venture capitalist, investor, technologist, and philanthropist. This blend creates a multidisciplinary perspective that drives financial performance and positive societal outcomes. By considering the broader implications of investments, these leaders help businesses thrive while addressing global challenges such as inequality and climate change.

Multirole innovators break down traditional industry silos, fostering collaboration and inspiring others to pursue both profit and purpose. Their actions redefine what it means to succeed in business, demonstrating that entrepreneurship and philanthropy can—and should—go hand in hand.

Real-Life Examples of Impact

The tech industry is teeming with trailblazers who exemplify this holistic approach. Leaders in Silicon Valley, for instance, have fueled the rise of world-changing startups before redirecting their resources to education reform, climate action, and public health. Their influence stretches beyond individual ventures, with their stories serving as blueprints for aspiring entrepreneurs and investors alike. They multiply their positive impact across sectors through mentorship, targeted investments, and generosity.

This ripple effect has been felt from clean energy accelerators in the U.S. to digital literacy initiatives in emerging markets. The collective efforts of such leaders demonstrate that visionary thinking and responsible investing can bring about lasting progress. For more detailed examples, visit MIT Technology Review: The Social Benefits of Tech Philanthropy.

Challenges and Opportunities

While the rewards are immense, navigating the intersection of venture capital, technology, and philanthropy comes with challenges. Regulatory changes, economic downturns, and rapid technological shifts can threaten the stability of even the most promising ventures. Resource limitations and shifting consumer preferences also require sustained adaptability. According to CNBC Finance, successful leaders must balance risk with long-term vision.

Nonetheless, the opportunities for meaningful impact have never been greater. Emerging markets, digital transformation, and cross-sector collaboration are unlocking new pathways for innovative ventures and philanthropic projects. Staying agile, learning from peers, and tapping into trusted industry research are key strategies for thriving in this environment.

Preparing for the Future

The convergence of venture capital, technology, and philanthropy continues to accelerate, offering unprecedented opportunities for positive global change. Future leaders must prioritize lifelong learning, open collaboration, and taking calculated risks. Building authentic relationships and embracing a service mindset will set apart those capable of navigating—and shaping—the next wave of innovation.

Adapting to change, seeking feedback, and aligning efforts with business and societal values will be defining traits of tomorrow’s changemakers. For those harnessing the synergy between investment, technology, and philanthropy, the potential to generate a meaningful and far-reaching impact is boundless.

A visionary approach to technology, investment, and philanthropy demonstrates how leadership can extend beyond profit to lasting impact. By fostering innovation, empowering entrepreneurs, and giving back to the community, this journey highlights the power of purposeful action in shaping a better future, where success is measured by growth and positive change.