Cryptocurrency Trading

The act of speculating on the price movement of cryptocurrencies to gain revenue is called Cryptocurrency Trading. Unlike traditional foreign exchange (forex), cryptocurrencies practice digital exchange where investors exchange their coins. However, cryptocurrency trading is a 24-hr digital market, unlike the conventional forex that closes at the end of the day.

CFDs and exchange are the two types of Crypto trading. CFDs or Contracts for differences is a financial agreement between buyer and seller based on the futuristic price of crypto coins, stock, or other financial assets. The seller of the CFDs will pay the buyer if the cost of the “asset” increases, and the buyer will pay the seller if the value of the “asset” decreases.

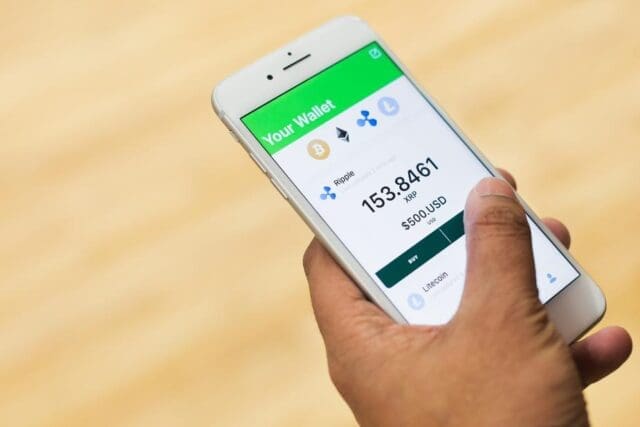

Another method of cryptocurrency trading is buying and selling coins via an exchange. The investor will purchase the coins and set up an account for the crypto exchange. Users will store crypto coins in a digital wallet, where their value is declared. The trader will then sell it when the coin valuation increases. This kind of cryptocurrency trading requires experience and knowledge of the technology. Traders must learn how to maneuver the data to their advantage. Cryptocurrency exchanges available online have deposit limits and are expensive to maintain. To know more about cryptocurrency exchange and start trading, you may visit Bitcoin Era.

Cryptocurrency: Operational Summary

Cryptocurrencies run across a network of computers. It is decentralized and is not controlled or distributed by central authorities, like banks or the government. Cryptocurrencies are shared through digital ownership and are stored on a blockchain. The sending of cryptocurrencies is done through “digital wallets.” Transactions must be verified and added to the blockchain through “mining.”

Trading by CFDs:

Investors will start a CFD account wherein derivative products will enable them to speculate and study the market prices of their cryptocurrencies. Prices will be quoted in traditional currencies (i.e., US dollars, Euro, etc.), and the investors are not entitled to cryptocurrency ownership. They can open a position for only a fraction of the entire trade’s value, meaning CFDs are leveraged products. Investors can gain substantial profits in leverage products, but the risk of losses is possible upon the market shift.

Leverage is an advantage for many traders. This CFD method allows the traders to open positions in large amounts of cryptocurrency without paying the trade trades’ full value small deposit, called the margin. When the trader decides to close the leveraged position, the gains or losses will be based on the trade’s full value.

Leverage may amplify profit returns, but the potential loss is a possibility like any other trade method. This trading method includes losses more like any different trade method margin paid by the trader. It is recommended that traders know how to manage and mitigate risks before opening a position by leveraged trading.

Margin, as aforementioned, is the initial deposit a trader must pay before opening and maintaining a leveraged position. It is usually expressed as a percentage of the actual valuation of the entire position. For instance, when trading on Bitcoin, the broker requires at least 15% of the total value of the position before opening. The margin requirement usually depends on the broker and how large the potential trade size is.

Like any investment, brokers will present two prices when opening a position in the crypto market. This method is called a cryptocurrency trading spread. A long position means the investors will trade at “buy price, ” a higher valuation than the market price. While a short position is trading at “sell price,” wherein the investor will pay for a price slightly below the market price.

Batches of cryptocurrency coins are used to standardize the size of trading. This method is also known as trading in “lots.” Investors can trade cryptocurrencies c in smaller or bigger lots. Since cryptocurrency prices are very volatile, the majority of lots in trading markets are small. They are usually one unit of the base cryptocurrency.

Pips is another term important to note in CFDs. These are units used to calculate the price movement of a cryptocurrency. At a specific level, it is a one-digit price movement. For instance, a trade price movement of $250.00 to $251.00 means that the cryptocurrency moved a single pip. A pip can be a dollar, cent, or a fraction of a cent.

Trading by Cryptocurrency Exchange

This type of trade is also known as Digital Currency Exchange (DCEs). This trade allows investors to trade digital currency with traditional currency or fiat money. Available exchanges enable credit card payments or wire money transfers in exchange for cryptocurrencies like Bitcoin, Ethereum, or Dogecoins. Digital currency providers keep and maintain cryptocurrency accounts for investors but are independent of their creators. They do not issue the digital currency or cryptocurrency directly to the investors. Usually, investors buy or sell their cryptocurrency from this digital currency exchange. DCEs then transfer the crypto coins into or out of the customer’s digital wallets or DCP accounts.

Many traders incorporate spread betting into their diversified investment strategies to achieve exposure across different asset classes and markets.

Centralized Exchange

These are composed of private companies that offer platforms for cryptocurrency trading. Usually, these companies require identification of the customers, also term as “Know Your Client Rule.” This type of exchange has high volumes, active trading, and liquidity. These private companies usually developed their servers and software. These centralized exchanges are convenient for new users and provide a minimal level of insurance for secure investments.

Decentralized Exchange

The central point of control does not exist for this kind of exchange. It usually has computer servers spread all around the world. An individual controls each computer that composed the server. Numerous computers run the network, and shutting down one computer does not affect the mechanism. Hacking this kind of exchange is challenging and almost impossible because of its decentralized method. Another advantage is that no regulatory body or government can have jurisdiction over this kind of exchange because no single individual or group controls the system.

Success in cryptocurrency trading is not a one-proven formula industry. Traders and investors study various methods, data, and technology, hoping for a significant return on their investments. As the market is volatile and a rapid shift in market price is possible, preparing and mitigating risks is highly recommended.

Featured Photo by Sarah Pflug from Burst